Outsourced Payroll Providers Can Boost Your Bottom Line

March 14, 2023Categorised in: News

Finding the right outsourced payroll provider for your business can help cut costs, boost productivity, and improve your employer brand — but how does that work in today’s challenging financial landscape?

Our CEO, David McCormack, explains how outsourced payroll providers can help you boost your bottom line.

Outsourcing Payroll For Better Efficiency

Businesses have a lot to deal with in today’s world of work, from digitisation and compliance to auto-enrolment and ever-changing tax and employment legislation. Combining this with a cost of living crisis, shifting working models, and employee mental health issues, companies must strive to make operations as efficient as possible.

Payroll plays a significant role in an organisation’s reputation and employee relationship, making it a business priority. Businesses must maintain an accurate, compliant, agile and flexible payroll to maintain excellent employee experience and operational efficiency.

While traditional outsourced payroll providers only cover payroll processing, modern outsourced payroll providers take on more responsibility for risk, delivering a service that focuses on the commercial impact, solves the increasing cost pressure, and offers a better experience for employees.

Finding The Right Outsourced Payroll Provider

Not only can an outsourced payroll provider help you to lower operational costs and increase employee productivity, but it can also boost your employer brand by supporting recruitment and employee retention.

The outsourced payroll provider you choose should guarantee delivery of compliant, on-time and accurate employee pay and should also:

Outsourced Payroll Providers To Avoid

Recruitment agencies have used outsourced payroll providers for many years, citing the main benefits of reduced downtime and business process optimisation.

However, there have been a few instances of tax avoidance from unscrupulous outsourced payroll providers, leaving temporary employees to face the financial penalty.

The new government guidelines highlight the responsibility of organisations to look more closely at their outsourced payroll provider and do regular, comprehensive due diligence to ensure their provider is ethical and compliant.

Unfortunately, unscrupulous outsourced payroll providers are not rare. Classed as Mini Umbrella Companies (MUC), they can put your organisation and employees at risk. Here’s how to spot a MUC:

Payments Coming From Unusual Companies

In a MUC, payroll payments come from limited companies with random and frequently-changing names. The MUC model requires payroll companies to make few payroll payments, so they only use up to the employers’ NI allowance. By using multiple limited companies, MUCs can access multiple employment allowances.

Unclear Pay Deductions

Pay deductions are not transparent, with few to no employers’ NI paid on employees’ pay. HMRC classes this as tax fraud, and an outsourced payroll provider that is a MUC could leave you liable.

Flat-Rate VAT Accounting

MUCs will utilise flat-rate VAT accounting to make additional income without keeping accounting records.

Suspicious Company Information

Another giveaway of a MUC is that they operate out of serviced offices, bulk mailboxes or offshore addresses. The Companies House registration information will usually differ from the Trading Group name.

Their directors and shareholders will also usually be non-UK nationals and non-resident or non-tax residents of the UK.

Trusted Outsourced Payroll Providers In The Recruitment Industry

Many of our clients operate in the recruitment sector and have lots of experience in choosing the right outsourced solution, let’s take a look at 2 of them who have shared their advice;

Specialising in GLAA-regulated sectors like food processing and agriculture, Premiere Recruitment has an average weekly payroll of 250 workers and has chosen to outsource payroll since launching in 2021.

The company’s director, Leon Vickers, has this to say about outsourced payroll providers:

“Payroll must be on time, accurate, and compliant, or there are catastrophic consequences. While handing payroll to an outsourced payroll provider is terrifying, it is ideal for busy businesses like us. Working with a legitimate, reputable outsourced payroll provider has boosted our efficiency, saved costs, delivered peace of mind, and freed up extra time and mental space to focus on growing the business.

There are many outsourced payroll providers, so investing in your comprehensive due diligence is vital to finding the right one for your business. Some of the things you can do to find the right provider are:

First Base Employment has been outsourcing its payroll for 20 years; its founder, Patricia Hay, has also commented on their experience with outsourced payroll providers.

“Having payroll professionals on board is very reassuring; trust comes over time, but before choosing an outsourced payroll provider, ask them for evidence of their communication, technology security, customer testimonials, and values.

Invest time in understanding how each outsourced payroll provider can add value to your organisation. Supporting employees is so important; if your provider includes access to employee benefits, that makes them a great option. As a company, it’s fantastic to offer the whole team access to counsellors, GPs, and resources to help employees navigate the cost of living crisis.”

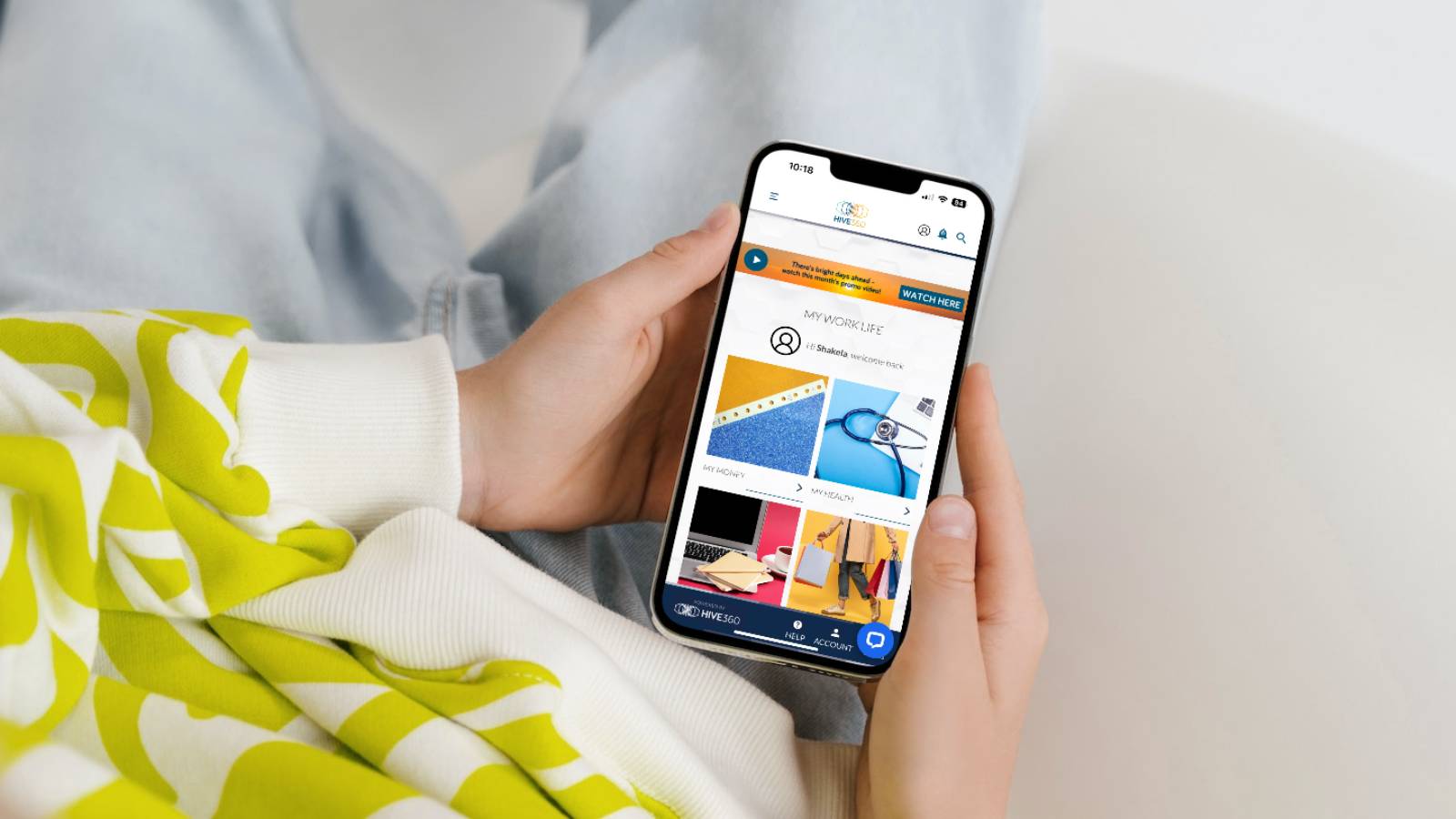

HIVE360 delivers an all-in-one payroll outsourcing solution, which includes access to our Engage Employee Benefits app. Contact us to see how you can save money, boost productivity and improve your employer brand.