Your End of Year Payroll Checklist

March 30, 2021Categorised in: Laws & Regulations, News, Payroll

The end of the payroll year is quickly approaching, but it doesn’t need to be stressful! Processing can be done with peace of mind with a bit of forward planning.

To help you prepare and process year-end, our Payroll Supervisor Anna Kowalska has prepared a checklist of 8 key things you need to do:

1 – Make sure your P60s are ready

On the 5th April 2021, all employees working with you on the final day of the tax year need to receive a P60 from you by the 31st May 2021 – which summarises their pay and deductions for the year

2 – Process holidays over the transition

If any employees are on holiday over the year-end, only process their holiday up to the 5th April 2021. Anything after this date can be processed in week one of the new tax year.

3 – Check whether your payroll ends on week 52 or 53

If the pay date falls on the 5th April 2021, it’s important to check whether your payroll ends on week 52 or week 53. But don’t stress, if your employees are paid monthly, you won’t have a week 53, so continue as normal.

If you pay some or all of your employees on a weekly, fortnightly, or four weekly basis, you don’t have a week 53 if your normal pay rate falls on the 5th April 2021. However, you do have a week 53 if any of these mean your normal pay date falls on the 5th April 2021. If this is the case, you just need to complete your payroll for 5th April 2021 by your normal means before processing your year-end.

4 – Process any leavers

If any workers have left your employment, it’s important to process them as leavers before you submit your Full Payment Submission (FPS) and Employer Payment Summary (EPS).

5 – Submit your final FPS

You can send your final FPS (and EPS if required) once you have checked when your payroll ends, processed the final payroll, and made any amendments to leavers.

You would need to process your final pay period and submit your last FPS for your final pay period as part of the preparation. Your year-end processing is done via an internet submission, and the deadline for this is the 19th April 2021.

In the final pay period, there is no difference to the FPS and EPS, so you can submit them as normal.

6 – Process your year-end and make your final submission

Your processing date needs to be set up for the 5th April 2021 ready for you to process your year-end and make your final submission for the 2020/21 tax year.

You can then produce your P60s, which employees need to receive by the 31st May 2021.

7 – Report your expenses and benefits

You will need to submit a P11D form to HMRC for each employee you’ve provided with expenses or benefits. You must report expenses and benefits to HMRC by the 6th July 2021. To find out more about expenses and benefits, visit the government website here.

8 - Update tax codes, national minimum wage, and thresholds for the new tax year

Make sure you are familiar with the rates and thresholds for 2021-2022 and make updates where necessary. To find out more, visit here

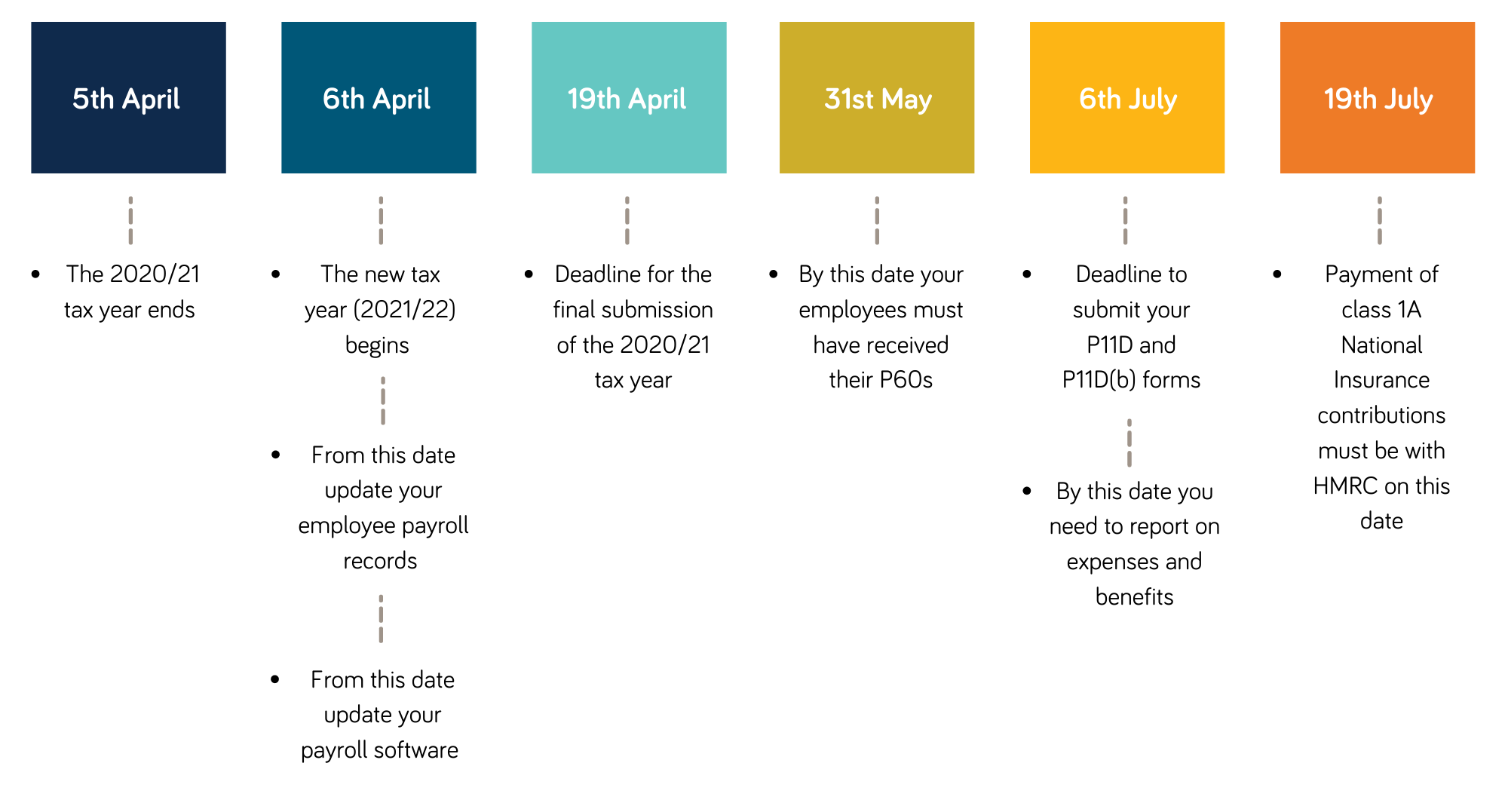

Key Payroll Dates:

A complete solution to payroll and benefits

With HIVE360 Support Services Ltd, you have a reliable and expert partner to help ease the burden of your critical employment administration and compliance, but we do things a little differently to the traditional payroll providers.

We take a holistic view that focuses on delivering compelling cost savings to your business and factors in boosting your employees’ experience and wellbeing too by including our branded employee benefits and wellbeing app as standard.

Our solution will help you to kick start your employee engagement with a sophisticated mobile Engage App platform for your people, that brings everything together. It’s a win-win!

Whether you’re looking to fully outsource your payroll and auto-enrolment pension administration, streamline your payroll function or simply improve on your payslip communication – we’ll design a Payroll Solution to Suit Your Operation. There’s no setup cost, no capital outlay, and we work to minimise the disruption to your business and your people throughout implementation.